With the close of the second quarter we enter fully into the summer season. During this time of traveling, holidays, and family time, we also look back on the year so far. There are several economic factors that hold relevance to our portfolios that are worth looking at in more depth.

ECONOMIC UPDATE

With the close of the second quarter we enter fully into the summer season. During this time of traveling, holidays, and family time, we also look back on the year so far. There are several economic factors that hold relevance to our portfolios that are worth looking at in more depth.

Oil:

The current summer driving season is usually considered our busiest period in terms of fuel consumption, but despite the growing local and global oil demand (which is set to push global consumption above 100 million barrels per day) the supply still outweighs the demand. This supply overhang has led to a morose sentiment for oil and a reversal in energy prices. This fall in prices may have subdued inflationary pressures, particularly in Canada, but with its heavy TSX weighting of 31%, we can see that the TSX is up only 0.7% year to date.

Interest Rates:

Even in current conditions, for the first time in almost seven years, the Bank of Canada (BoC) has hiked its benchmark interest rate 25 basis points from 0.50% to 0.75%. As with any policy change, there are positives and negatives. An increase in interest rates eventually translates into higher borrowing costs, which is bad news for Canadians who are already overburdened with high amounts of debt at $1.67 for every $1 of disposable income. But another negative effect of rising interest rates applies to existing bondholders. As interest rates and bond prices move inversely, rising interest rates have led to a decrease in bond prices, leaving existing bondholders with less valuable bonds. Depending on the coupons/interest received, this might not be enough to compensate for a decrease in bond price and could in fact lead to an overall negative return on bond holdings. In light of rising interest rate pressures, by June 30th, the bond index in Canada (XBB) had only returned -0.38% for the past year.

But ultimately, an increase in interest rates is a good thing. We have been in a period of emergency rates for a long time, and the BoC is stepping off the gas as it finally witnesses signs that our economy is strengthening. The Canadian economy grew at 3.7% in the first quarter and is projected to have grown at 2.5% in the second quarter, which is above trend.

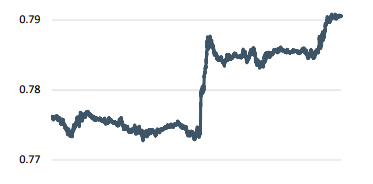

Higher interest rates reward savers who can now also expect higher yield rates in the bond market and last but not least, higher rates impact the Canadian dollar as we saw it sharply rise against the US dollar.

CAD/USD - July 10 to July 14

Equity Prices and The Stock Market

Although Capstone seeks opportunities outside of the traditional arena, we do still look to the stock market and consider equity prices. After all, the stock market still tends to be a leading indicator of the economy even though it has perhaps become less predictive since the beginnings of Quantitative Easing (QE). Within the stock market, we see valuations stretched across risky assets at a time when one of its key drivers, monetary policy accommodation, has been waning. We know that the stock market moves in cycles and that we have been in a bull market since 2009. Some pundits have even compared the current phase of the market cycle with being in the seventh inning stretch. Given these circumstances, we see more downside risk than upside potential in the equity markets and a well-diversified portfolio is prudent.

The Rest of The World

Canada may be the world to us, but since we only make up 2% of GDP, we would be foolish to only look inside our nation for information and opportunities. For example, we look very closely at our neighbours to the South because any changes, whether it be trade deals or tax cuts, may have profound effects on us as well. In addition, even though the US has taken centre stage lately, China represents our second largest trading partner and has a large impact on our domestic economy. In fact, Chinese credit has been slowing considerably and this is something to watch for as it may indicate an overall decrease in their economic growth. After all, a significant slowdown in China could lead to lower commodity prices, which directly impacts our Canadian stock market and our economy as a whole.

The Bottom Line

These summaries represent a macro view of the global economy as it relates to Canadians and we believe it is important to have a general overview before focusing on individual investments. That said, we consider each investment as an individual opportunity and evaluate it based on its own merits. Our primaryp concern will always focus on whether it has the potential to maximize return while reducing risk, and we feel we have achieved this goal at Capstone through our disciplined approach. In fact, evidence of this can be seen when analyzing the risk adjusted returns of our portfolios using the Sharpe Ratio. This mathematical formula measures the return against the standard deviation, a measurement of volatility. A higher Sharpe represents lower volatility with higher returns. Over the past year, a traditional stock/bond balanced portfolio had a Sharpe Ratio of 1.6 versus Capstone’s balanced portfolio of 4.1. This means that by comparison, Capstone’s clients received 2.5 times more return for the risk that was taken, compared with what they could have received in a purely traditional stock/bond balanced portfolio. At Capstone, we are convicted that true portfolio diversification is critical to insulate portfolios against volatility from any single factor that is occurring within the marketplace. Incorporating a combination of traditional and non-traditional investments has provided our clients with solid returns while reducing risk.

UNDERSTANDING HEDGE FUNDS

For the average investor, hedge funds are perhaps one of the most misunderstood and feared investment categories. Many believe them to be infinitely risky and will immediately shy away from any exposure in their personal investment portfolio. However, the truth is that Hedge funds come in all different shapes and sizes. It is true that some can be incredibly risky, but some can also be significantly risk averse. It is not the risky-ness that makes up the definition of a hedge fund, but rather the unique strategy that is implemented by the manager for the sole purpose of earning an active return, or alpha. In fact, instead of referring to them as hedge funds, you may often hear us refer to these types of investments as “Alpha Seeking Strategies,” since this terminology ultimately defines their purpose. Hedge fund managers are typically experts in a niche market, where they seek to find and exploit inefficiencies within that arena. These opportunities can often be shortterm in nature, and not large enough to benefit large funds. For this reason, many hedge funds are small and nimble and can move in and out of positions efficiently. One strategy that we implemented last November 2016 and sold in May 2017 attempts to exploit the inefficient relationship between bond yields and credit spreads. When we entered this position, credit spreads were historically wide and we anticipated they would narrow closer to their historical average. If that were to happen, we predicted this strategy would produce equity-like returns with bond-like risk. If the credit spreads widened to their 2015 high (widest since 2008), the return would likely be better than what we could achieve in the cash-equivalent market, with volatility similar to the XBB (Canadian Bond market index). Considering where credit spreads were, we determined the profile for this strategy to be low to medium risk and likely short-term in nature as the eventual narrowing of spreads would eliminate its future profitability. Over the course of 6 months, credit spreads indeed narrowed significantly and the pool realized a 5.7% return (which is an annualized return of 11.4%). Another example of a hedge fund strategy that we have employed relies on the expertise of the funds’ manager who implements event-driven strategies in ‘special situations’ such as merger arbitrage, pair trades and long/short positions. In this scenario, the return opportunities are not dependent on strong markets. Instead, the manager is looking to invest in securities they have identified as having both value and a catalyst. A catalyst could include any major event occurring in a corporation, such as an implementation of new technology or management, a change in dividend strategy, or a merger or acquisition. If the results are expected to be negative, this fund manager may also decide to short the company and profit in that way. As this strategy is entirely dependent on the specific dynamics occurring within the company they are investing in (or shorting). This strategy has proven to be completely uncorrelated to traditional equity market performance and has averaged a return of 9.3% annually since 2014. Because hedge funds implement an alternative strategy that differs from traditional market funds (such as an index fund or typical mutual fund), it naturally finds a home within the Capstone Non-Traditional Equity Pool. By incorporating a variety of non-traditional investment options, including hedge funds, we can offer our clients a truly diversified portfolio with excellent risk-adjusted returns.

HELPING ADULT CHILDREN

There is a certain stage in life when our children become financially independent. Despite this independence, parents realize that it can be tough to get ahead and they see the value in helping out now. Some choose to gift money to help their children with wedding costs; others may choose to fund RESPs for their grandchildren. A lot of benefit can come from gifting now rather than upon passing. Distributing some assets now avoids non-registered assets having to go through probate and the associated fees that come with it. The giver is then able to witness the impact and joy that their gift in the present can have on their children. Monetary gifts are essentially an early inheritance, so this doesn’t need to change the amount that you had intended to give to your child/children; rather it just changes the timing of your gifting. One last thought of consideration: some parents have intended gifts to be for a certain purpose, such as a down payment for a home, and are disappointed when their child chooses to spend it another way, such as a BMW! Be clear about your intentions for the monetary gift to avoid this type of situation.