Equity

Capstone Canadian Equity Income Strategy

About this Strategy

Investment Process

Capstone's Canadian Equity Income Strategy aims to deliver returns through regular dividend income and long-term capital gains, focusing on publicly-traded large-cap Canadian companies. Managed within a client’s Separately Managed Account (SMA), this approach allows investors to directly hold shares, offering potential tax advantages like gain and loss harvesting and benefits for charitable donations. Capstone prioritizes high-quality Canadian firms, characterized by market-leading products, sustainable competitive advantages, prudent debt levels, balanced capital allocation, and experienced, ethical management. This strategy emphasizes both income generation and capital appreciation for investors.

This Strategy is for

Investor Profile

This strategy is suitable for investors who:

- are looking for capital gains and dividend income through active management following a value-based investment philosophy.

- wish to invest in companies with proven management teams, strong cash flows and earnings growth.

- want traditional equity exposure with lower risk than broad stock market indices

- are able to accept a medium to high level of risk.

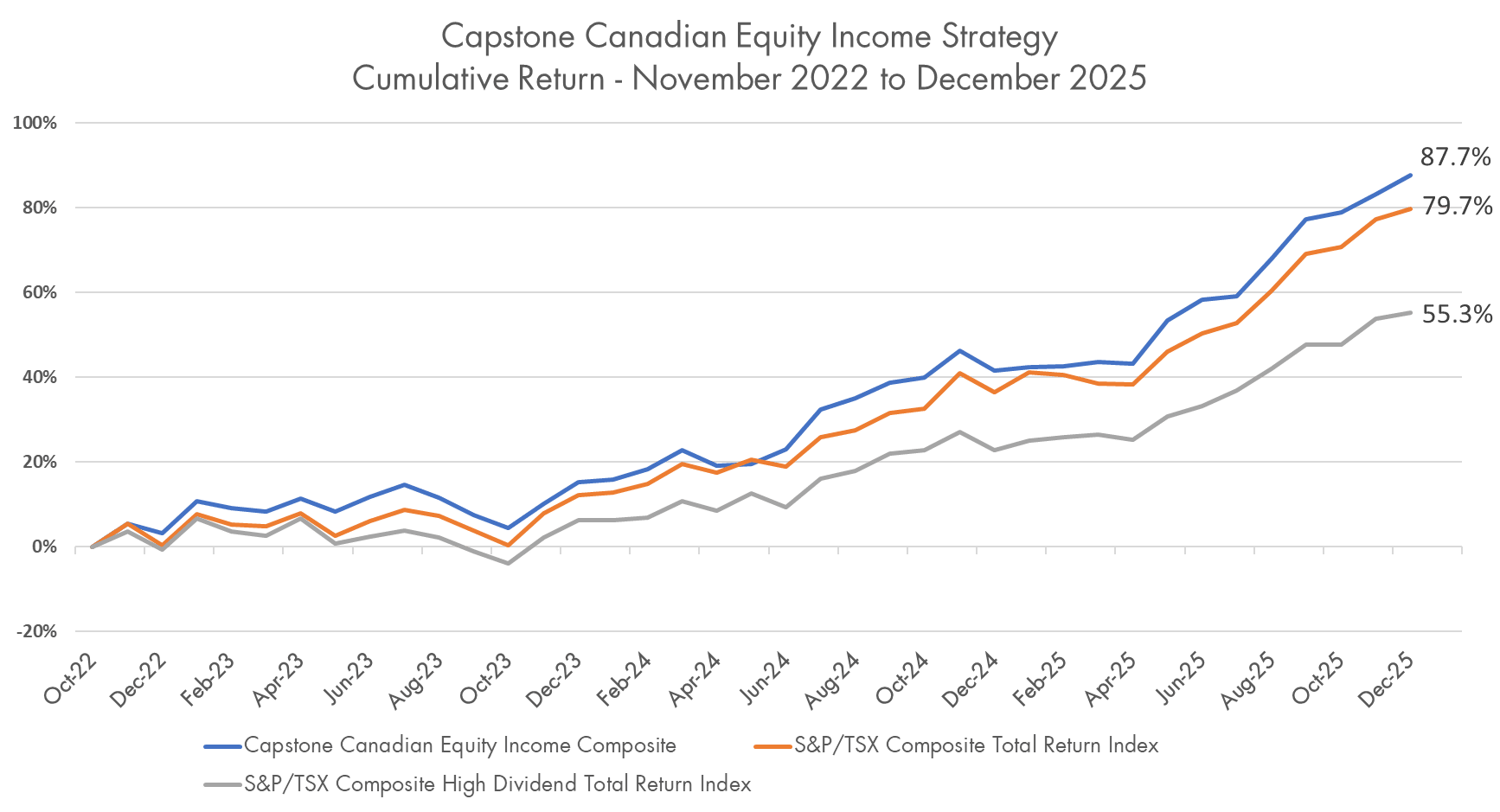

The performance data provided here is that of a Composite of all CCEIS managed accounts that meet the firm’s composite construction policy. It is intended to provide only a general overview of the performance of the CCEIS Strategy. While individual account performances are reported to investors on a money-weighted basis, Composite performance is provided on a time-weighted basis, includes the reinvestment of dividends and income, and is net of all transaction costs but gross of management fees. Because of these factors, variations in account size, timing of investments, and other factors such as customized investment restrictions and tax strategies, the performance of the Composite will not accurately reflect the experience of any individual investor. Past performance is not indicative of future results and investors should not rely solely on performance data when making investment decisions.