Managing your finances isn’t just about numbers—it’s about forming strong habits, planning ahead, and setting yourself up for long-term stability. Whether you're just starting your financial journey or looking to fine-tune your strategy, there are a few key areas that deserve your attention: savings, investing, registered accounts, charitable giving, estate planning, and insurance.

Let’s break down each area and how they fit into a complete financial picture.

Savings vs. Investing: Why You Need Both

Savings and investing serve different (but equally important) purposes.

- Savings are for short-term needs and emergencies. The money should be easy to access and low-risk.

- Investments are generally designed for long-term growth and may involve more risk, though some can offer quicker access or lower risk depending on the strategy.

Q: Why can’t I just invest everything?

Because emergencies happen, life happens. Without an accessible savings buffer, you could be forced to tap into long-term investments—like retirement accounts—at the wrong time, which could cost you in penalties, taxes, or missed market gains, among many other consequences.

Smart Saving Habits:

- Pay yourself first: Set up automatic transfers to your savings as soon as your pay cheque comes in.

- Use bonuses or raises wisely: If your day-to-day budget doesn’t rely on the extra funds, consider putting them into savings or investing them.

- Double win: Contribute to your RRSP and use your tax refund to build your emergency savings.

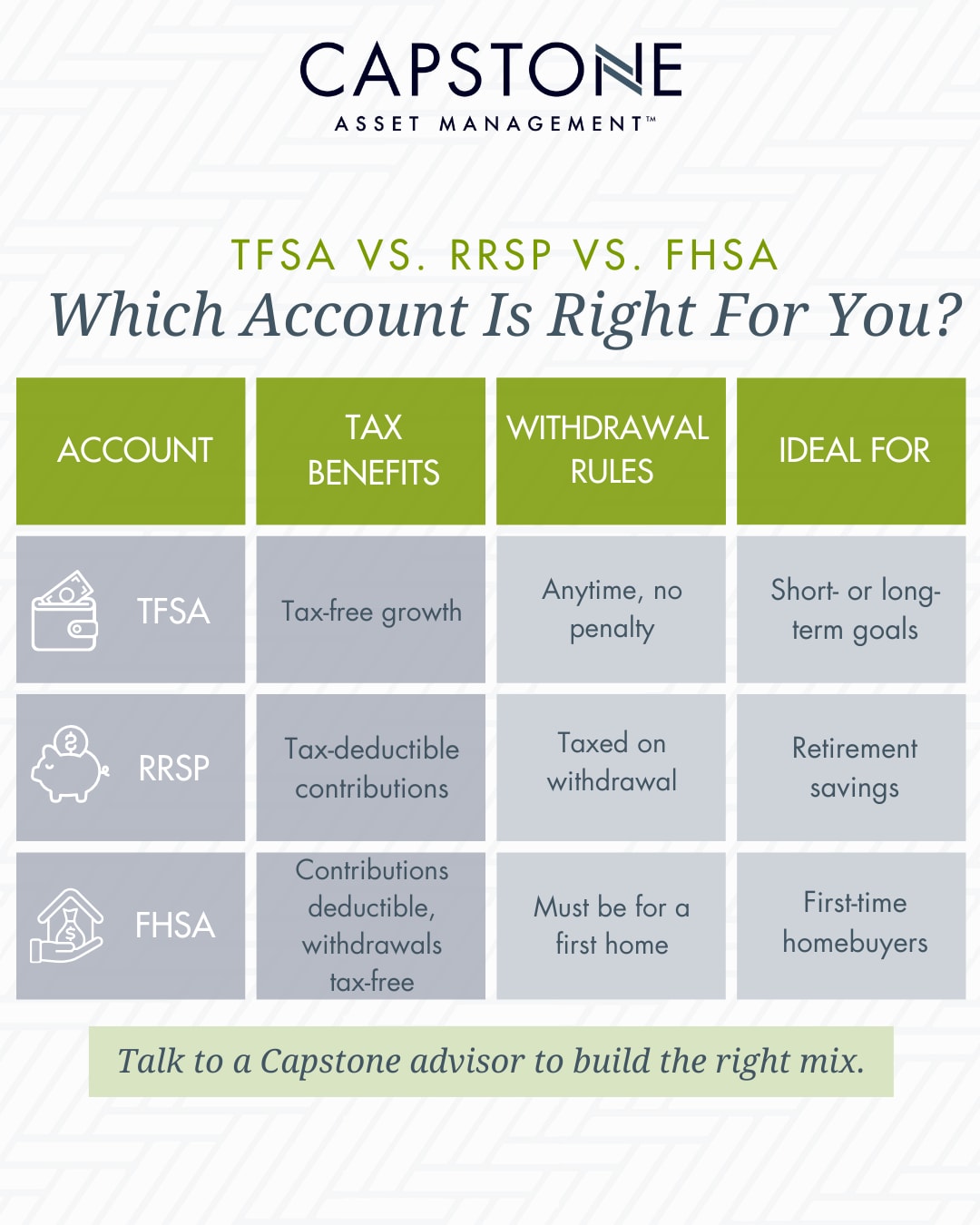

Maximize Your Registered Accounts: TFSA, RRSP, FHSA

Canada offers several tax-sheltered investment vehicles that can help you grow your wealth more efficiently.

Tax-Free Savings Account (TFSA):

- Contributions are not tax-deductible, but growth and withdrawals are tax-free.

- Use it for anything, anytime—no tax consequences on withdrawals.

- Great for short- or long-term goals.

Registered Retirement Savings Plan (RRSP):

- Contributions reduce your taxable income.

- Growth is tax-deferred until retirement, when your tax rate may be lower.

- You can also borrow from your RRSP for a first home or education under specific programs.

First Home Savings Account (FHSA):

- A newer tool aimed at first-time homebuyers.

- Tax-deductible contributions and tax-free withdrawals (if used for a home).

- Annual contribution limit: $8,000

- Lifetime limit: $40,000

Q: I’m not sure which account is right for me. What should I do?

Speak with a financial advisor to evaluate your short- and long-term goals. Your strategy might involve using more than one account depending on your income, age, and priorities.

Giving Is a Financial Practice Too

Charitable giving isn't just a nice gesture—it can be part of your financial and spiritual health.

- One simple way to start and stay consistent is to consider automating your giving, similar to how many people automate their savings.

- Giving regularly can help build generosity into your financial habits.

You’ll also receive tax receipts for charitable donations, which can reduce your taxable income through non-refundable tax credits.

Q: What if I feel like I don’t have enough to give?

Even small, regular contributions can make an impact. The point isn’t the amount—it’s building the habit. As your financial situation improves, your giving can grow with it.

Don’t Forget Estate Planning and Insurance

Planning for the unexpected can be empowering and provide peace of mind.

Estate Planning:

- Have a valid, updated will and powers of attorney.

- Review your documents annually or whenever your life circumstances change (e.g., marriage, children, business changes).

- Keep your intentions clear to avoid confusion or legal disputes in the long run.

Insurance:

- Consider insurance as a financial protection tool—not just for you, but for your loved ones.

- Evaluate your needs: life, disability, critical illness, or business-related insurance.

- Younger = lower cost: The earlier you get coverage, the more affordable it tends to be.

Q: Do I need insurance if I’m young and healthy?

It’s often easier and more affordable to get insurance while you’re young and healthy. Securing it now can offer peace of mind down the road, especially if your health changes later.

There’s no one-size-fits-all financial plan, but strong habits and thoughtful planning are a good foundation. From building up your savings to using tax-sheltered accounts wisely, giving intentionally, and preparing for life’s unknowns, each element plays a role.

At Capstone Asset Management, we’re here to help you build an investment strategy that reflects your values and supports your goals. Contact us today to explore your investment options.

.jpeg)